Kentucky income tax set to reduce by half a percent

BOWLING GREEN, Ky. – A measure to lower the state income tax has recently cleared a hurdle in the house and is now waiting for approval in the Senate.

House Bill 1, or the income tax reduction bill, is part of a process to eliminate income tax in the state of Kentucky. The bill will reduce the income tax for the 2026 year from 4% to 3.5%.

One state representative says they took this approach to reduce by half a percent every year if certain goals are hit to ensure Kentucky stays financially healthy. But just how much money is going back to Kentuckians pockets?

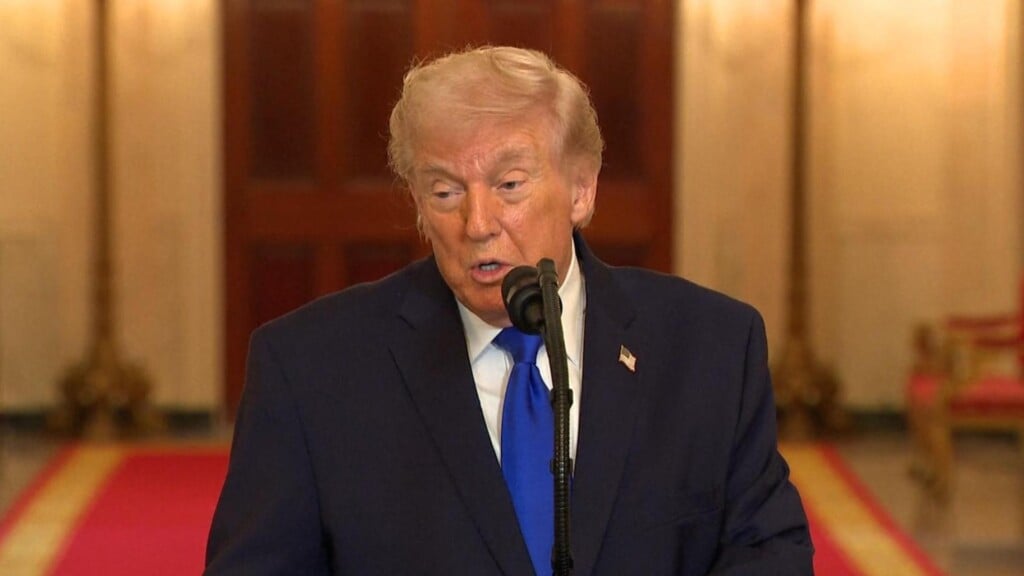

“The average Kentucky family saved $1,500 a year in taxes based on the original 6% down to the 3.5%. So they’ll save a little over $1,500,” Kentucky State Rep. Steve Riley said.

Riley says these tax reductions accomplish two goals. One, to put more money back into people’s pockets, and two, it makes Kentucky more business friendly and compete with states bordering Kentucky, like Indiana and Tennessee that have already dissolved state income tax.

To read more about House Bill 1, click here.